Building a diversified stock portfolio is one of the most effective strategies for managing risk and optimizing returns in the stock market. Diversification involves spreading investments across various sectors, asset classes, and geographies to reduce the impact of any single asset’s poor performance on the overall portfolio. This article will guide you through the process of creating a diversified stock portfolio, explaining its importance, strategies, and best practices.

Why Diversification Matters

Before diving into the mechanics of building a diversified portfolio, it’s essential to understand why diversification is crucial.

1. Risk Management

One of the primary benefits of diversification is risk management. By spreading investments across different sectors and asset classes, investors can mitigate the impact of volatility. For instance, if one sector experiences a downturn, other sectors may perform well, helping to cushion the blow.

2. Potential for Higher Returns

A well-diversified portfolio has the potential to achieve higher returns over the long term. By including various asset classes, you can benefit from the growth of multiple sectors, increasing the likelihood of capital appreciation.

3. Reduced Volatility

Diversification can help smooth out the fluctuations in your portfolio’s value. While individual stocks may be volatile, a diversified portfolio typically experiences less extreme price swings, leading to more stable returns.

4. Access to Different Opportunities

Investing in a variety of sectors and asset classes allows you to take advantage of different market conditions. For example, certain sectors may thrive during economic expansion, while others may hold up better during downturns. A diversified portfolio provides exposure to these varying opportunities.

Steps to Build a Diversified Stock Portfolio

1. Determine Your Investment Goals

Before constructing your portfolio, it’s essential to clarify your investment objectives. Consider the following questions:

- What is your investment horizon? (Short-term, medium-term, or long-term)

- What are your risk tolerance levels? (High, medium, or low)

- What are your financial goals? (Retirement, purchasing a home, funding education, etc.)

Understanding your goals will help you tailor your portfolio to meet your specific needs.

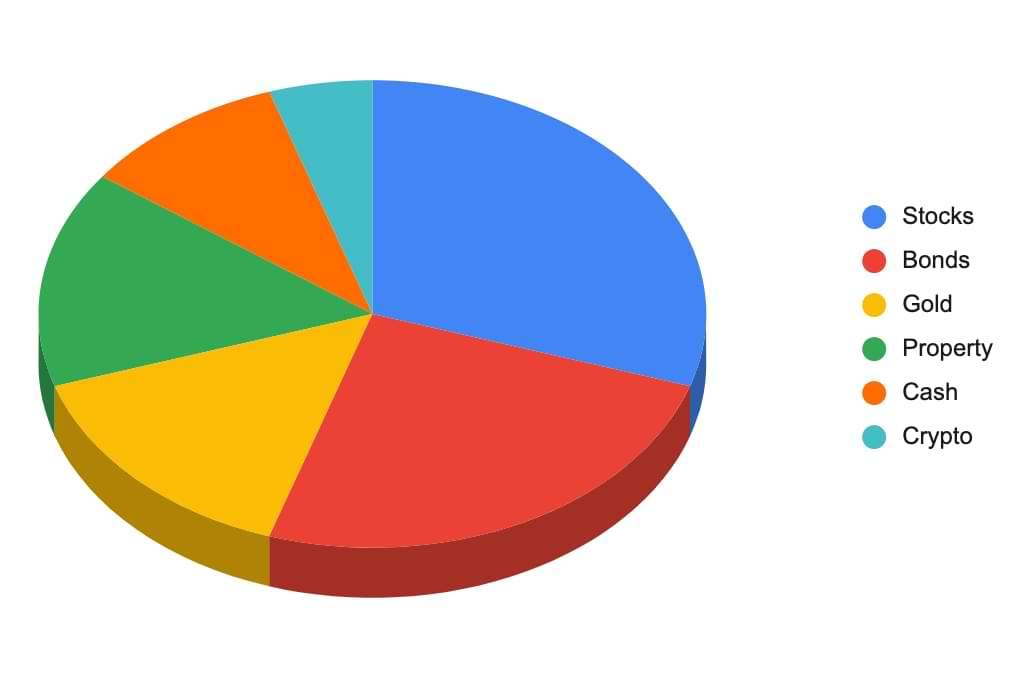

2. Understand Asset Allocation

Asset allocation is the process of dividing your investment portfolio among different asset classes. The main asset classes include:

- Stocks: Equities that represent ownership in companies.

- Bonds: Debt securities that pay interest over time.

- Real Estate: Investments in property or real estate investment trusts (REITs).

- Cash and Cash Equivalents: Savings accounts, money market funds, and short-term Treasury bills.

Your asset allocation should reflect your risk tolerance and investment goals. Generally, younger investors may opt for a higher allocation to stocks for growth potential, while those nearing retirement may prioritize bonds for stability.

3. Choose the Right Stocks

When selecting stocks for your portfolio, consider the following criteria:

a. Sector Diversification

Invest in stocks from various sectors to reduce sector-specific risk. Major sectors include:

- Technology

- Healthcare

- Financials

- Consumer Discretionary

- Consumer Staples

- Energy

- Utilities

- Materials

- Industrials

Aim for a balanced representation of sectors in your portfolio, ensuring no single sector dominates your investments.

b. Geographical Diversification

Consider investing in both domestic and international stocks. Global markets can perform differently based on various economic factors, so having exposure to international stocks can provide additional diversification.

c. Company Size Diversification

Diversify your investments across different company sizes, known as market capitalizations. This typically includes:

- Large-cap stocks: Established companies with a market cap over $10 billion.

- Mid-cap stocks: Growing companies with a market cap between $2 billion and $10 billion.

- Small-cap stocks: Emerging companies with a market cap under $2 billion.

Including a mix of company sizes can enhance growth potential while balancing risk.

4. Invest in Index Funds and ETFs

If you prefer a hands-off approach, consider investing in index funds or exchange-traded funds (ETFs). These funds pool money from multiple investors to purchase a diversified portfolio of stocks that track a specific index, such as the S&P 500.

a. Benefits of Index Funds and ETFs:

- Cost-effective: Lower management fees compared to actively managed funds.

- Instant diversification: You gain exposure to many stocks within a single investment.

- Simplicity: They are easy to buy and sell, and they require less research than individual stocks.

5. Regularly Rebalance Your Portfolio

Over time, your portfolio’s asset allocation may shift due to varying returns from different investments. Rebalancing involves periodically adjusting your portfolio to maintain your desired asset allocation. Here’s how to do it:

- Set a schedule: Decide whether you will rebalance monthly, quarterly, or annually.

- Determine thresholds: Establish thresholds for asset classes. For example, if your stock allocation exceeds 70% of your portfolio, consider selling some stocks and buying bonds to restore balance.

- Avoid emotional decisions: Stick to your rebalancing strategy and avoid making decisions based on short-term market fluctuations.

6. Stay Informed and Adaptable

The financial landscape is constantly changing, and staying informed about market trends, economic indicators, and company performance is essential. Regularly review your portfolio and make adjustments as needed based on changing market conditions or shifts in your financial goals.

7. Consider Professional Guidance

If you’re uncertain about how to build a diversified stock portfolio, consider seeking advice from a financial advisor. They can help assess your financial situation, create a tailored investment strategy, and provide ongoing management of your portfolio.

Common Mistakes to Avoid

1. Over-Diversification

While diversification is important, over-diversifying can dilute potential returns. Investing in too many assets may lead to lower overall performance. Focus on quality investments that align with your goals rather than simply spreading your capital too thin.

2. Chasing Past Performance

Avoid the temptation to invest in stocks or funds solely based on their past performance. Historical returns do not guarantee future results. Conduct thorough research and consider fundamental factors before making investment decisions.

3. Neglecting to Monitor Your Portfolio

Even a well-diversified portfolio requires ongoing monitoring. Failing to keep an eye on your investments can lead to missed opportunities or failure to address underperforming assets.

4. Ignoring Fees and Expenses

Investment fees can significantly impact your overall returns. Be aware of management fees, trading costs, and expense ratios when selecting funds or stocks. Opt for low-cost investment options whenever possible.

Conclusion

Building a diversified stock portfolio is essential for managing risk and optimizing returns. By understanding your investment goals, choosing the right stocks, and regularly rebalancing your portfolio, you can create a robust investment strategy that withstands market fluctuations.

Remember to stay informed, be adaptable, and consider seeking professional guidance if needed. With careful planning and execution, you can successfully build a diversified stock portfolio that aligns with your financial goals and helps you achieve long-term investment success.

Final Thoughts

Diversification does not eliminate risk entirely, but it can significantly reduce it. As you embark on your investment journey, keep in mind the importance of patience and discipline. The stock market can be unpredictable, but a well-constructed diversified portfolio can help you navigate the ups and downs with confidence.